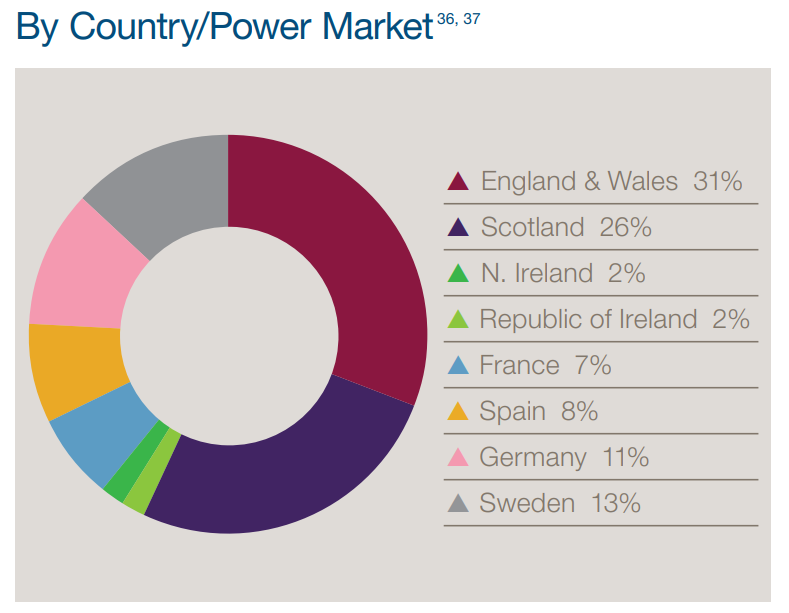

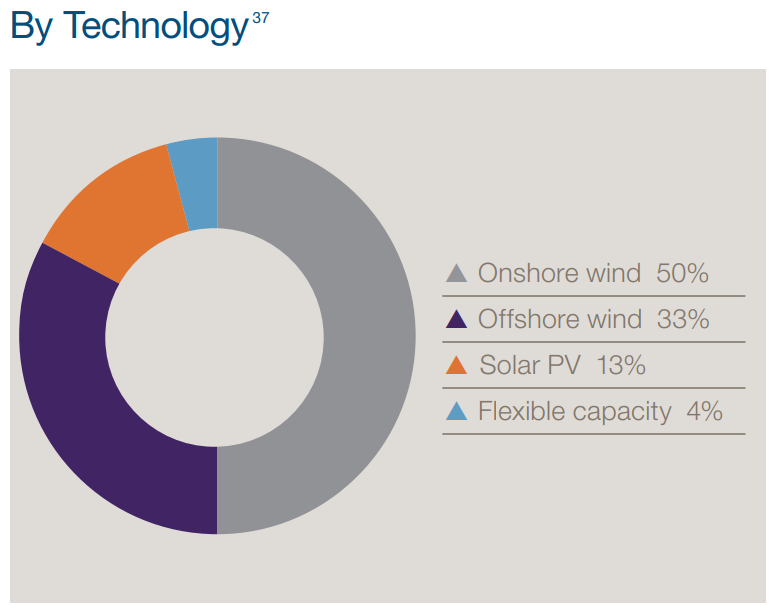

TRIG invests across Europe in geographies that have a stable regulatory framework in wind, solar and related technologies such as battery storage. Diversification of geography and technology gives the portfolio exposure to different weather systems, regulatory environments and electricity markets while avoiding reliance on any single market. This strategy of portfolio growth and diversification supports the long-term investment proposition of delivering stable and sustainable dividends together with NAV resilience.

Combining assets across the available range of revenue options (from fully subsidised to completely unsubsidised) allows returns to be maintained at attractive levels whilst keeping power price exposure consistent. Increasingly a greater range of tools are becoming available to manage power price risk on assets exposed to market power prices and provide options to hedge power prices at a portfolio level, reducing the overall risk to the portfolio. With the changing dynamics of the energy system, the Managers continue to focus on power price exposure as a key metric to mitigate the risk associated with reductions in power prices.

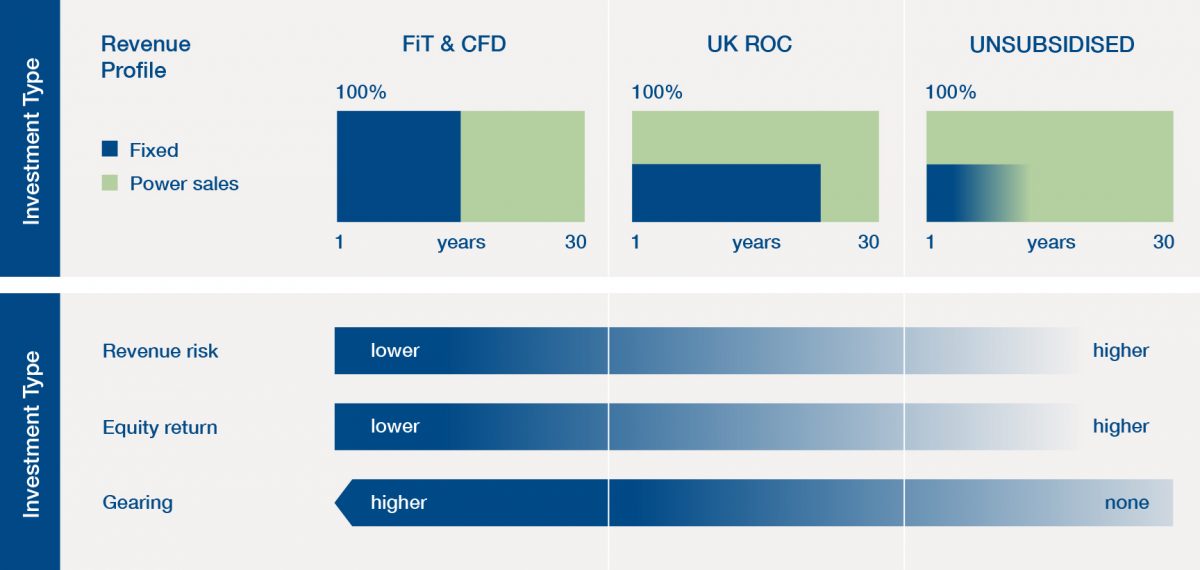

A consequence of the greater visibility of revenues in the structure of CfDs, such as those used for newer subsidised offshore wind investments, or Feed in Tariffs, is that these projects can accommodate higher levels of financial gearing relative to ROC-subsidised or unsubsidised projects. This is shown as a simplified illustration below.

Revenue profile

Range of revenue options within a balanced portfolio

FiT & CFD contracts (France, Ireland, Germany and UK) typically have subsidy revenues of 15 years then market revenues for the balance of a project’s life

- Least revenue risk (early on), scope for highest gearing, lower equity return

ROC projects (UK) have a mix of subsidy and market revenues for the first 20 years of a project’s life

- Medium revenue risk, moderately geared, average returns

Unsubsidised projects without subsidies (may have hedging or PPAs which mitigate power price exposure). Equity returns correlate with revenue risk, with safer capital structure

- Highest revenue risk (long term), least/no gearing, higher equity returns

Portfolio segmentation (as at 31 December 2022)

36 Northern Ireland and the Republic of Ireland form a Single Electricity Market, distinct from that operating in Great Britain.

37 Segmentation is based on the portfolio value on a committed basis.