Past performance is no guarantee of future returns. There can be no assurance that targets will be met or that the Company will make any distributions, or that investors will receive any return on their capital. Capital and income at risk.

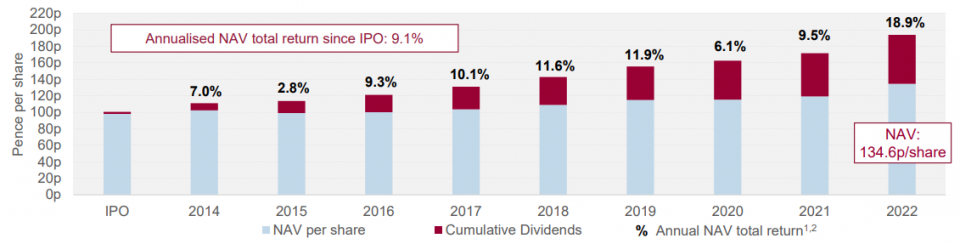

The chart below shows how the combination of dividend and Net Asset Value (NAV) growth2 has delivered a total return of 9.1% from IPO to 31 December 2022.

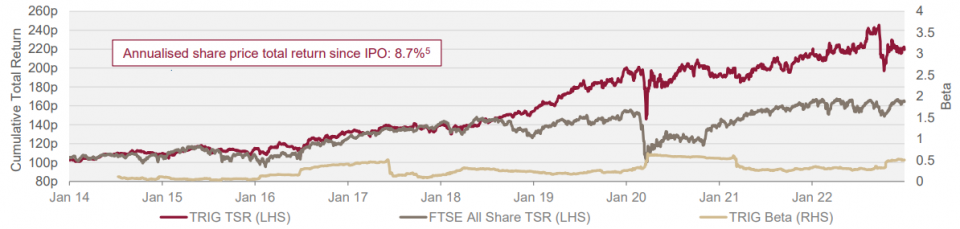

The chart below shows how, since its launch in 2013, TRIG has outperformed the FTSE All share while offering a low beta3.

Source: InfraRed, Thomson Reuters Datastream

1 Past performance is not a reliable indicator of future results. There can be no assurance that targets will be met or that the Company will make any distributions, or that investors will receive any return on their capital. Capital and income at risk.

2 Based on NAV per share appreciation plus dividends paid from IPO till the period ended 31 December 2022 on an annualised basis

3 Reuters using 250 day rolling beta.

5 TSR is the total shareholder return based on a share price plus dividends paid from IPO till the 31 December 2022 on an annualised basis.